School districts across the country are tasked with the challenge of trying to save every dollar they can. Facility managers already know that pushing resources to their limits is absolutely necessary in creating sustainable operations, as the funding for maintenance, capital improvement projects, and educational resources is still lacking.

With so many obstacles, how can school leaders position their facilities and school staff for long-term success and sustainability? Prioritizing energy upgrades and taking advantage of shared energy savings programs is a great place to start since those projects often pay for themselves.

School Sustainability Hurdles

Public schools in the U.S. are already facing an $8-billion shortfall for annual operations and maintenance—more than the cost of textbooks and computers combined—and according to a report by the 21st Century School Fund in partnership with the National Council on School Facilities, the U.S. is projected to underinvest in school buildings by a gap of $46-billion annually. View their infographic to learn more.

Districts have become more creative with how they save money, but it’s still a challenge to manage old infrastructure while attempting to maintain low utility costs. Funding to replace aging equipment, like lighting and HVAC systems, is not always available and students and staff require sufficient spaces that are conductive to learning. For many schools, deferring maintenance becomes the knee-jerk response.

The cost-savings achieved by expanding on energy efficiency enables schools to fund critical facility upgrades, like roof replacement, resolving asbestos and mold issues, security camera installation, classroom remodels, and other critical facility needs.

What is a Shared Energy Savings Program?

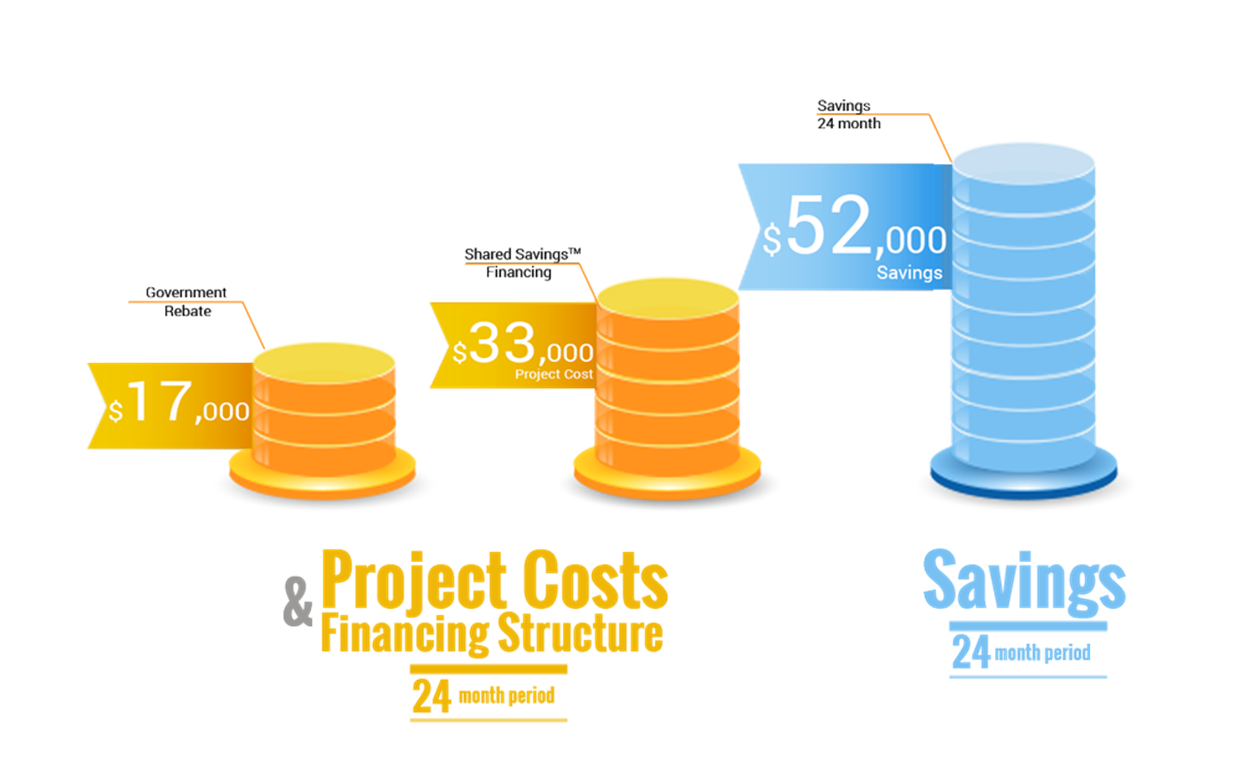

A shared energy savings program is a revolving loan fund offered by utility providers (and some private companies) to finance energy-efficient improvements to your facilities.

Your utility provider provides up-front financing and the majority of shared savings programs give your organization the option to repay all or part of the loan through the energy savings generated—often with no up-front investment required.

The energy savings achieved through a shared savings program, and the resulting energy savings, benefit everyone by shifting funds (otherwise spent on utility bills) back into building improvement projects.

Benefits of Energy Efficiency and Shared Savings Programs

Improving energy efficiency can help schools to address the challenges they face, such as increasing energy costs and compromised classroom conditions. Improving your school’s energy efficiency, by eliminating waste and reducing operating costs, frees up a larger portion of your budget to use on educational programs and building improvements, both of which can enhance the quality of your educational services which, in-turn, improves your student’s academic performance.

Life-Cycle Cost of Delaying a Project

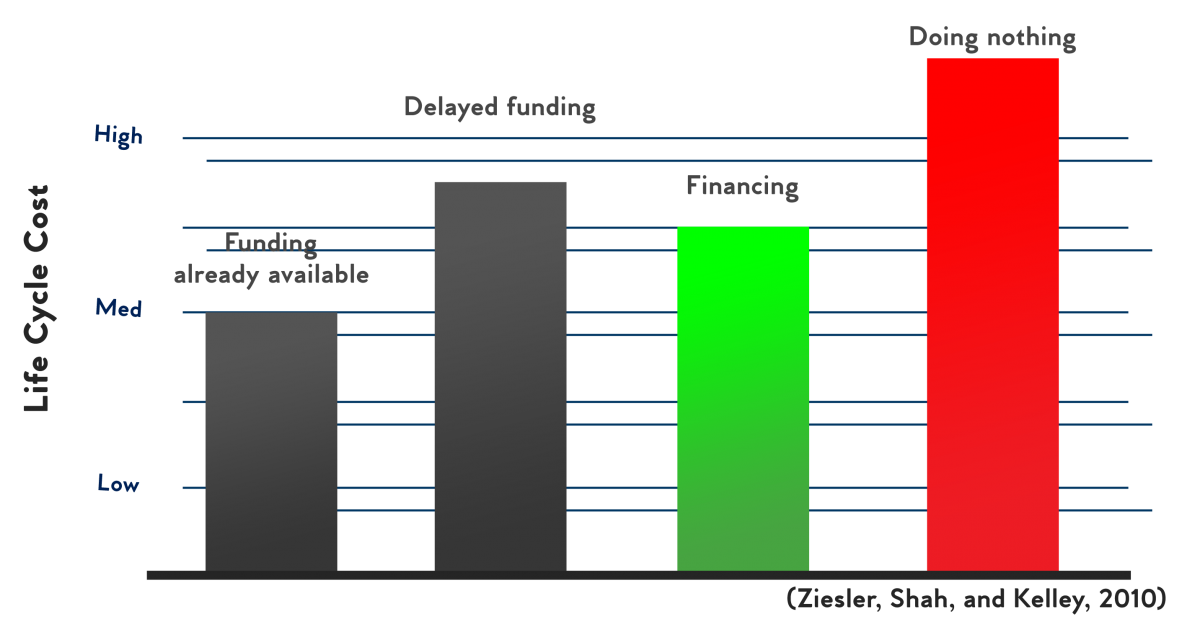

We’ve established clear benefits to being energy efficient, but what about the funding for these energy efficiency upgrades? Immediate access to the necessary funding is not available for many schools. However, leaving underperforming equipment to fail prior to upgrading or replacing it is costly and counterproductive.

There are four possible approaches a school can take when dealing with these types of upgrades: use available allowances to install immediately, wait for future capital budget allowances, use financing for the installation of upgrades immediately, or do nothing. The following graph shows the comparative costs of these four options.

The option with the lowest cost is to make improvements with capital budget allowances that are currently available (funding available today). Although this scenario is ideal, it’s often unrealistic as many school districts have limited budgets.

The next option is to wait for future capital budget allowances (or delayed funding). The total cost of waiting for future capital budget funding before replacing inefficient equipment is greater than the cost of financing the upgrades immediately, which, in many scenarios, begins paying for itself as the energy saved offsets the cost of financing the replacement equipment.

Using that same logic, doing nothing (taking no action) should be your last choice, as it’s the most-costly by a wide margin, as schools continue paying costly energy bills and defer required maintenance.

Shared energy programs enable schools to pay for upgrades over time by using the future savings generated by those same upgrades thus bridging the financial gap to make energy efficient upgrades a reality today.

Sustainability that Pays for Itself

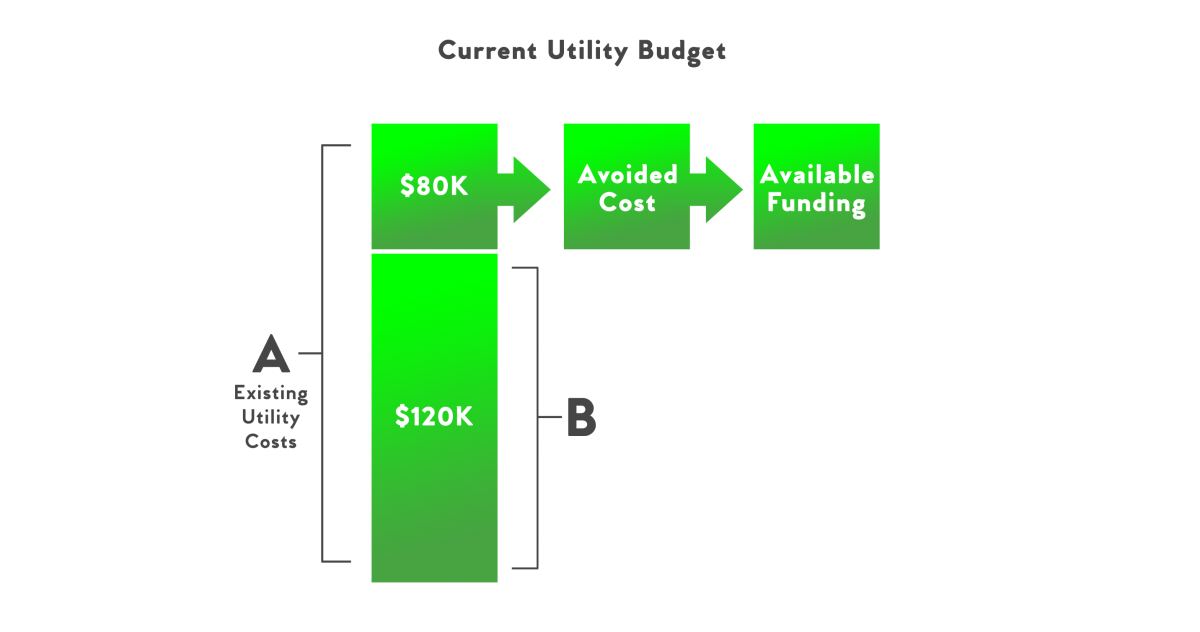

Shared savings programs, and other energy performance contracts, give schools the power to cover the expenses of energy efficiency over time by utilizing the savings created via those same upgrades—known as energy conservation measures—essentially turning the savings-generated into avoided costs.

These programs operate on the understanding that schools will utilize the avoided expenses to satisfy the cost of the installed upgrades. The following graphic is an example of a school that is initially paying an amount “A”, which equals $200,000 per year in utility bills. The school in this example predicts that by installing energy saving upgrades it can reduce its utility bills by $80,000 per year, resulting in a post-upgrade bill “B” of $120,000 per year. The difference is the “avoided annual cost,” money that would have been spent on energy bills but can now be used to finance further energy conservation methods.

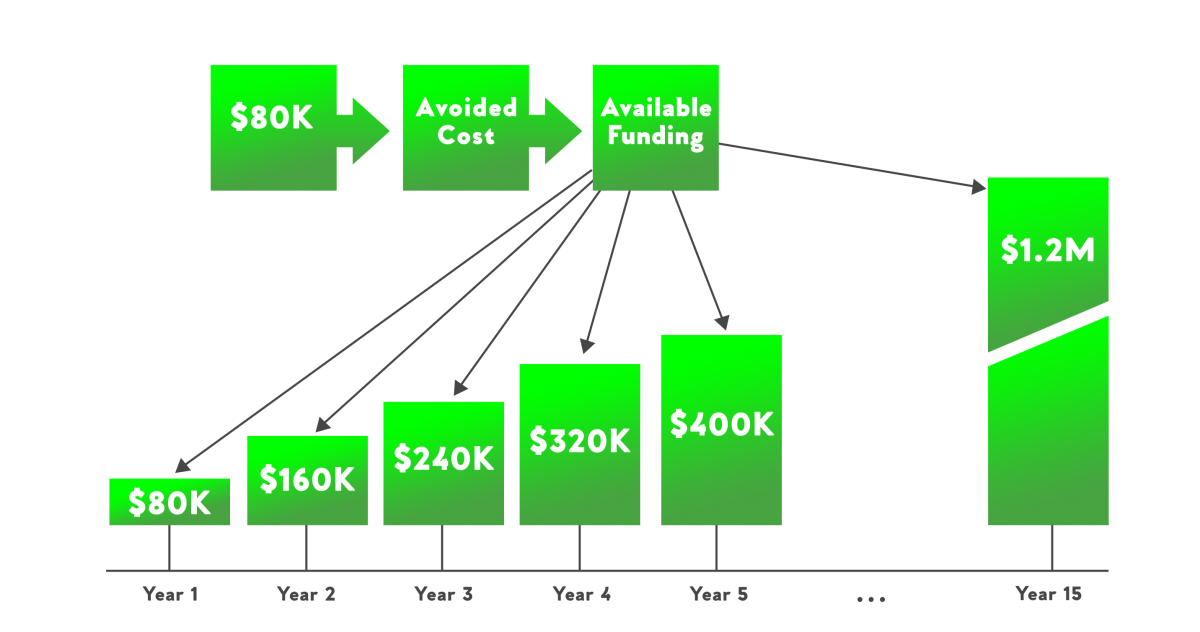

Over time, these yearly avoided costs aggregate, allowing the school to pay for the initial overhaul and then implement additional upgrades that save even more energy (see graphic below). Essentially, these programs allow the upgrades to pay for themselves. After satisfying the initial cost of financing, the outcome is a permanent decrease in operating expenses. Even before full reimbursement, the school, its student, staff, and teachers can enjoy the environmental and health benefits of new hardware.

How to Get Started

Step 1: Contact

Reach out to your utility provider (Alliant Energy, MG&E, We Energies, etc.) for more information, and speak to the account manager, or energy services representative, that oversees your organization to determine your eligibility.

Step 2: Analyze Savings

You can review the energy-saving benefits of the improvements you are considering with your account manager, or instead chose to work with other experts (i.e. designers, contractors, consultants, engineers, Focus on Energy, etc.) to determine the value of savings for your project. If you elect to use an outside expert, it’s recommended that you get the opinion of your account manager on your savings estimates.

Step 3: Analyze Costs

Financing options that match your project’s estimated savings will be provided by your account manager, in an effort to structure financing payments that fit the pattern of energy savings created by your project. You can then choose which financing options is the best fit for you.

Step 4: Making a Decision

Based on the cost and savings estimates, you decide whether to proceed with the project or not. There may be additional analysis required, or you may choose to proceed with the project itself.

Step 5: Shared Savings

If you choose to follow-through with using Shared Savings funds to finance your project, your utility provider may then seek to obtain financial information from your organization. After fufilling a review, and establishing your company’s creditworthiness, a loan agreement is prepared.

Step 6: Loan Agreement

Your account manager will gather the necessary information and prepare a draft financing agreement that you can review. If accepted, your utility provider, or financing company, will finalize the documents for you to sign.

Step 7: Signatures

You can instruct your project’s contractor to begin the work only after all the signatures needed have been obtained on the loan agreement.

Step 8: Funds Released

Your utility or financing company will disburse progress payments until all the required funds have been released.

Step 9: Repayment

Your utility company will begin billing you for repayment of the Shared Savings loan; typically repayments can be satisfied using the reduced energy costs supplied by your energy-efficient upgrades.

Shared Savings Programs FAQ

How can the funds be used?

Funds received from the program can be applied to the direct costs of your qualifying project. Typically, this includes the equipment, materials, and labor for a complete project. In some cases, indirect, or soft costs, related to the project may qualify to be included in the project scope.

How are savings shared?

It’s up to you. You can choose to allocate all of most of the project energy savings created in the early years toward paying off the loan, or you might choose to pocket a larger portion of the savings up-front (however, this may prolong the time needed to repay the loan). Regardless, you decide how quickly savings are applied toward loan satisfaction versus other financial choices.

Are shared savings the same as a rebate?

No. Shared savings programs are not an up-front cash incentive, and do not have the same immediate financial reward for energy conservation projects as rebates provide. Since the savings program’s loan must be repaid, the financial reward stems from the subsequent excess energy savings.

Why use a shared energy savings program?

The main benefit to these programs: they help save energy. But other indirect benefits can also prove to be substantial, such as: reduced maintenance costs, increased comfort, productivity, and morale, increased property value, and environmental benefits. As mentioned above, a shared energy savings program can also aid in preserving your capital dollars and credit lines for other projects.