Tariffs have been a growing concern for importers in the United States since President Trump’s first two rounds of tariffs on Chinese goods earlier in 2018. For those unaware, you can essentially summarize a tariff as a tax on imported or exported goods between nations.

Overview of U.S.-China Trade War

Within the first few months of 2018, the Trump Administration enacted tariffs on imported solar panels, washing machines, steel, and aluminum. By July 6th of 2018, the U.S. began implementing the first China-specific tariffs as U.S. Customs and Border Protection (CBP) began collecting a 25% tax on imported Chinese goods valued at $34 billion. Shortly after, on September 24th, 2018, the United States implemented a second round of tariffs at an initial rate of 10%—which will later increase to 25% by January 1st, 2019—on an additional $200 billion worth of goods, including: semiconductors, consumer products, textiles, food and agriculture products, commercial electronic equipment and more. The additional tariffs are on top of penalties enacted earlier this year on $50 billion worth of goods, which are estimated to impact nearly 50% of the products that China sells to the United States every year.

The key goal of the Administration’s trade war with China is to reduce the US’s trade deficit with China and offset China’s weak intellectual property protections. The hope is that putting tariffs on key imports like steel and aluminum will lower U.S. demand for Chinese goods and help to stimulate domestic manufacturing. Another objective of the trade war is to undermine the Chinese government’s “Made in China 2025” initiative, which aims to make the Chinese the global leaders in advanced technology. The Administration’s hope is that the tariffs will provide U.S. manufacturers of advanced technologies a continued competitive advantage over the Chinese.

Some U.S. companies like Cree, who manufacture semiconductor technologies like light emitting diodes (LEDs) and power semiconductors, have denounced the effect of the tariffs on its business. Cree claims Trump’s trade war with China will only diminish their competitive edge and provide their Chinese competitors with an opportunity to surpass U.S. innovation. Greg Merritt—VP of Marketing and Public Affairs for Cree—insists that the tariffs will bring adverse effects, including: slowing Cree’s R&D, raising the cost of Cree products, and allowing China to gain on the company’s technological advancements.

How Will the Tariffs Impact the Lighting Industry?

Some claim the new tariffs will contribute to the reshoring of U.S. manufacturing jobs, but many manufacturing and engineering companies are already suffering from the new laws. A large number of manufacturers in the US have already announced price increases due to the tariffs on components or lighting imported from China. These manufacturers will have two options if the trade war continues to escalate: adopt a new approach in their manufacturing process in-order to curb pricing or engage the supply chain to source cheaper parts and materials. For lighting companies, the biggest impact will be the taxes implemented on steel and aluminum, which most-certainly affect imported items such as LED fixtures, lamps, and lighting components.

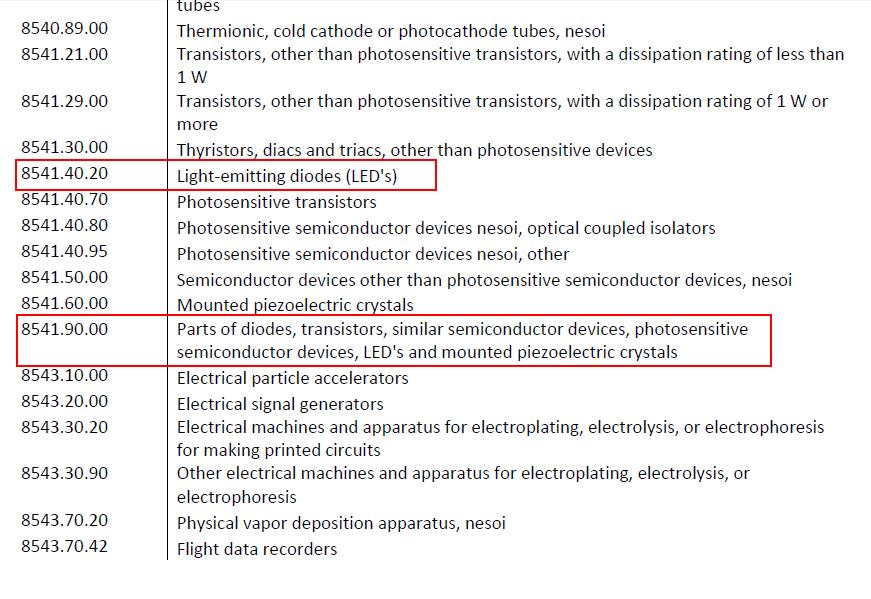

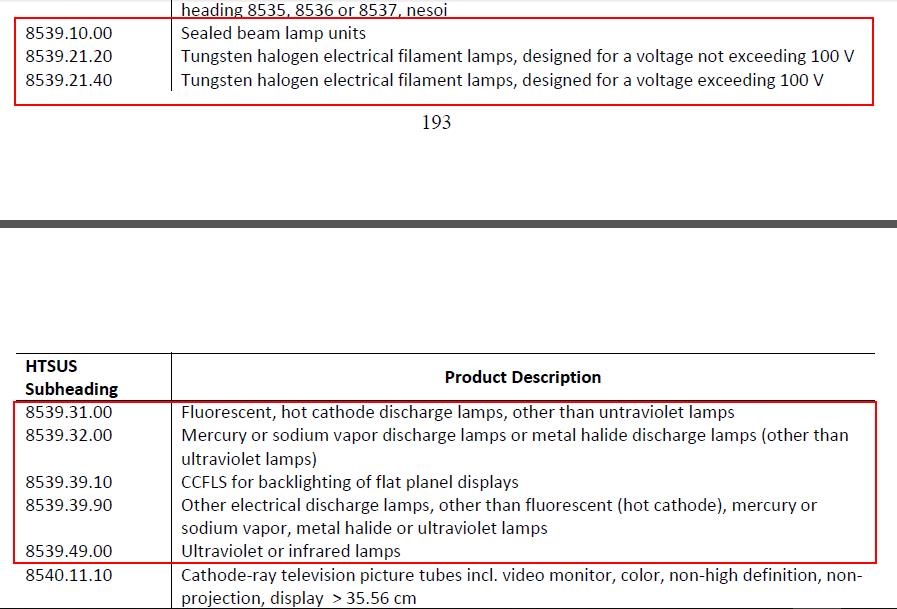

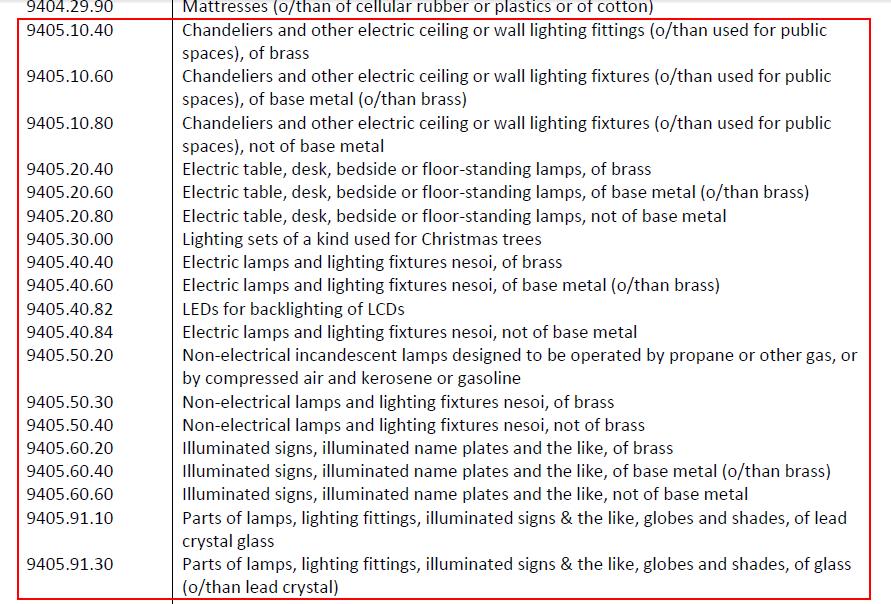

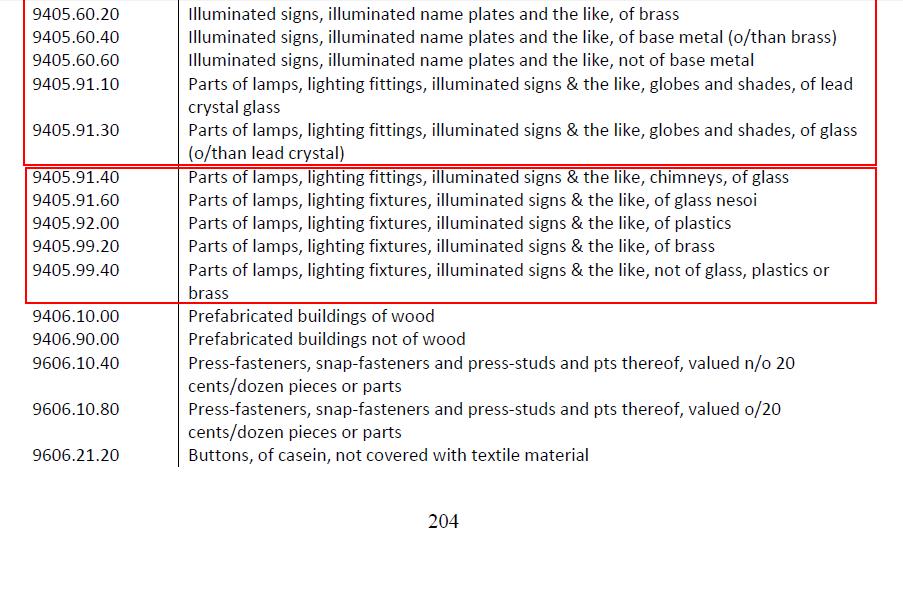

The current tariff list includes:

In Conclusion

The additional costs will likely have a direct impact on the cost of any lighting upgrade project and may potentially increase the longer you wait. If you’re looking for strategies on counteracting the additional costs prompted by the new tariffs, contact the lighting experts at Energy Performance Lighting by phone at (608) 661-5555 or email us at info@energyperformance.net. The trade war may seem inescapable in the short term, and may result in damage on both sides, but that won’t prevent the folks at EPL from preparing in-advance and developing a plan to minimize losses.